When starting a business in the Twin Cities, it's essential to set up the correct business structure and select the best entity for your business.

Is an S-Corp right for your business? Learning more about this structure and how our accountants at Passageway Financial can help your company is essential.

When starting a business in the Twin Cities, select the best structure for your needs. Consider factors like ownership, liability, and taxes.

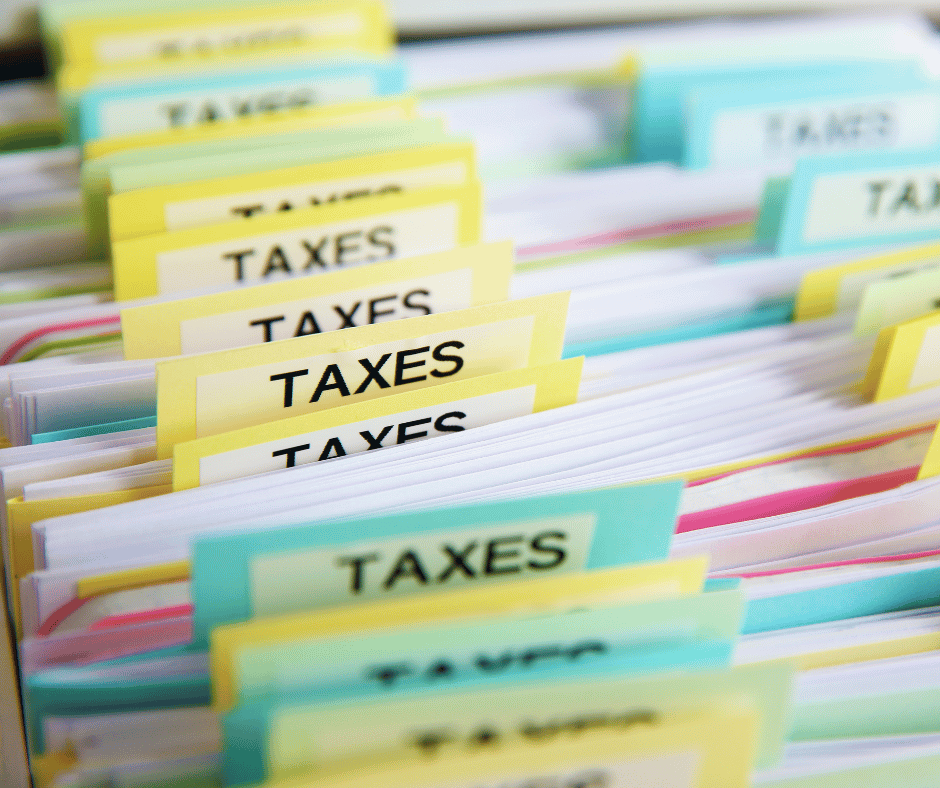

An S-Corp is a pass-through entity, meaning profits and losses flow through to the individual shareholders' tax returns. This avoids double taxation, making it a popular choice for small businesses in the Twin Cities.

When setting up an S-Corp for your Twin Cities business, taking the proper steps is essential. These can include:

Choose a Business Name: Ensure your name is not already in use and complies with Minnesota state regulations.

Register with the Secretary of State: File the Articles of Organization with the Minnesota Secretary of State.

Obtain an Employer Identification Number (EIN): Apply for an EIN from the IRS.

Draft Operating Agreements: Create an operating agreement outlining how your S-Corp will be managed and operated.

Meet the Requirements for S-Corp Status: To qualify for S-Corp status, your business must meet the following criteria:

File Form 2553 with the IRS: Within 75 days of the start of your business's tax year, file Form 2553 with the IRS to elect S-Corp status.

There are numerous factors to consider when determining if an S-Corp is right for your business entity. These can include:

While there are pros and cons to each type of business entity, there are key benefits to forming an S-Corp. Some of the top advantages include:

What does converting to an S-Corp mean for your business? Work with Passageway Financial to establish perfect financials, operations, cash controls, and tax reduction strategies.

.png)

.png)

.png)

.png)

.jpg)

.jpg)

.png)

.jpg)

.png)

.png)

.png)