To run a thriving digital marketing business, you must maintain a well-organized financial system.

Choosing the right Certified Public Accountant (CPA) is key to managing your finances effectively and complying with legal requirements.

They take all of your financial planning, bookkeeping, payroll, and accounting out of your hands so you can keep doing what needs to be done for the business.

However, with so many CPAs out there, it can be challenging to know how to choose the right one for your business.

To help you make the right choice, we've put together a guide containing 12 tips that can be useful whether you're a startup or looking to switch CPAs.

To make an informed decision, consider the following factors:

Opt for a firm that has experience in the digital marketing industry and knows how to accurately minimize their taxes.

That firm would be familiar with the specific financial requirements and challenges of digital marketing.

Their experience will provide valuable advice and insights on managing your finances efficiently and effectively.

An experienced CPA can also provide valuable insights and advice on how to improve your financial position, reduce risks, and take advantage of new opportunities as they arise, especially in the growing digital marketing industry.

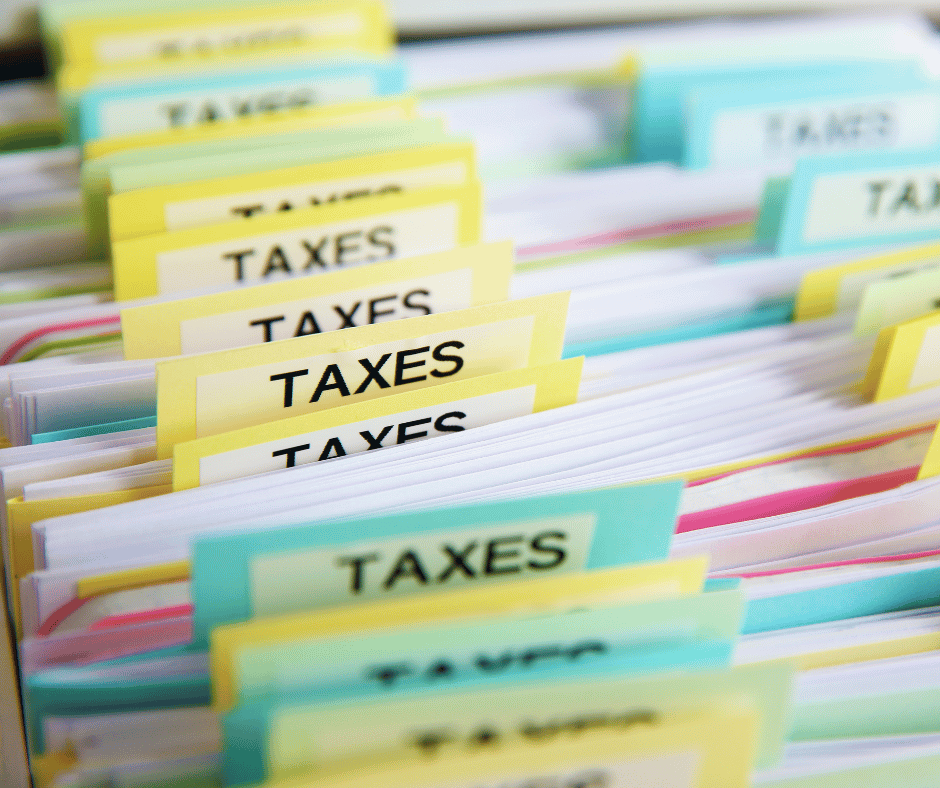

When selecting a financial firm, it is essential to choose one that offers comprehensive financial services to fulfill your business needs.

These services should include bookkeeping, payroll, financial reports, tax planning, tax reduction strategies, and consulting services.

A comprehensive approach allows the firm to identify potential issues or opportunities, and offer solutions that are customized to your business requirements.

Doing this will give you the best value for your money since you won't need to visit various firms for different financial services like payroll or tax planning, saving you time and hassle.

This means that by having a single CPA offering all your financial services, you'll have consistency and accuracy across your financial records.

Consistency is necessary because various CPAs or accountants may have different ways of managing your finances, leading to inconsistencies and inaccuracies, and harming your business's financial stability.

Ultimately, choosing a firm that provides comprehensive financial services is critical for ensuring your business's long-term success.

Engaging with your accountant or CPA year-round means meeting with them either quarterly or monthly.

This ongoing communication is important because as your business changes, you'll need financial advice that is tailored to your specific needs.

By having a CPA who understands your business and how it operates, they can provide valuable insights and advice to help you make informed decisions.

They can keep you informed about the latest tax laws and regulations, identify potential tax savings, and offer guidance on financial strategies that align with your business goals.

Building a strong working relationship with your CPA through year-round engagement can help you achieve your business objectives.

If you own a digital marketing agency, you need to make sure your CPA offers integrated services such as bookkeeping, tax planning, CFO services, and year-end tax returns.

This will guarantee efficient and accurate financial management as it provides a complete view of your finances.

With this approach, your CPA can identify opportunities and challenges while aligning your tax planning with your financial goals.

You also get the added benefit of having a dedicated CFO providing insight into your business's financial health and assisting with essential decision-making.

When your CPA offers integrated services, it streamlines your financial operations, giving you the guidance and support necessary to achieve your business objectives.

When looking for a new CPA for your digital marketing agency, reputation and credibility should be key factors to consider, as it indicates the CPA's level of professionalism and past performance.

You can look at the CPA's reviews on their Google business profile, or look to places like Yelp or Facebook to see if there are any reviews there.

A CPA with an established reputation and high credibility has a track record of delivering quality services, adhering to ethical standards, and fostering good relationships with clients and colleagues.

This assures you of their ability to handle your finances and provide reliable advice.

On the other hand, a CPA with a poor reputation or credibility may have a history of subpar performance, unethical behavior, or lack of transparency, which can lead to potential issues and legal repercussions for your business.

Therefore, opting for a reputable and credible CPA can guarantee high-quality service delivery and a positive business reputation.

A competent CPA must be highly knowledgeable in the latest accounting software and tools.

Understanding how technology can help you streamline financial operations and improve efficiency is another key competence to look for in an excellent CPA.

Using the latest technology and software enables the CPA to give you real-time financial reporting, complete tasks faster, and provide precise financial data.

Additionally, a CPA who is knowledgeable in technology can help you implement new financial systems and software that boost your business's performance.

Keeping up-to-date with the latest technology trends and tools ensures that your digital marketing agency remains ahead of the competition and can earn financial success in the evolving industry.

Effective communication is a crucial factor to consider when searching for a new CPA for your digital marketing agency.

This is because it helps to ensure that both you and your CPA are on the same page regarding your business's financial matters.

You should look for a CPA who can clearly communicate financial information in a way that you can easily understand and respond promptly to your queries and concerns.

They should be proactive in providing updates, recommendations, and advice to help you make informed financial decisions.

This kind of communication promotes informed decision-making in your business, preventing financial setbacks.

Every client is unique, and this is why a one-size-fits-all approach may not be suitable for everyone.

This is where a CPA with customized solutions comes in handy, especially for a digital marketing agency.

They can tailor their services to your business needs, providing relevant and practical advice and services to achieve financial goals.

They can also identify potential issues that could cause significant problems in the future, saving you valuable time and money in the long run.

With customized solutions, you can rest assured that your business is protected and poised for success.

Compare pricing structures and fees of different firms.

While cost should not be the sole determining factor, it is essential to find a firm that offers competitive and transparent pricing without hidden charges.

You will also want to find out if their pricing strategy aligns with what their services are.

It would also be worth it to try and negotiate with them about pricing.

Consult many firms and compare their services to the competitors.

Check whether the firm employs certified professionals, such as CPAs (Certified Public Accountants) or CAs (Chartered Accountants), who have the necessary expertise and qualifications to manage your financial matters.

These certifications are recognized and respected across the industry, and they demonstrate a level of professionalism and commitment to the field.

Having a CPA certification means that the accountant has passed a rigorous exam and has met certain educational and experience requirements set by their state or jurisdiction.

This assures you that the CPA has the necessary knowledge and skills to provide quality accounting and financial services to your business.

Certifications can be critical when it comes to verifying the credibility and expertise of a CPA or CA for your digital marketing agency, and this is why many clients and investors may seek them out.

The firm should have robust data security measures in place to protect your sensitive financial information.

Make sure they have a clear confidentiality policy and adhere to relevant data protection regulations.

Any breach of data security or confidentiality can have severe consequences, including legal and financial penalties, reputation damage, and loss of customer trust.

A growth-oriented approach is important for a CPA because it shows that they are not just focused on the current financial needs of your digital marketing agency, but also on its long-term growth and success.

A CPA who adopts a growth-oriented approach will collaborate with you to discover opportunities for expansion, offer guidance on financing options, and create financial plans that align with your business objectives.

This approach can guarantee that your digital marketing agency is on the path to long-term success and can adjust to changes in the market.

It can be quite challenging to locate the right CPA for your digital marketing agency, but it's paramount to managing your finances effectively and ensuring compliance with the law.

Are you ready to take the next step in managing your finances for your digital marketing business?

Look no further than at Passageway Financial!

If you're in the Minneapolis area, contact us today to learn how we can help you find the right CPA for your business needs.

We offer customized solutions, year-round engagement, and a growth-oriented approach to help you achieve your business goals.

Don't wait any longer, let us help take your business to the next level!

.png)

.png)

.png)

.png)

.jpg)

.jpg)

.png)

.jpg)

.png)

.png)

.png)